Free Quitclaim Deed Template for South Carolina

Other Popular Quitclaim Deed State Templates

Rhode Island Quit Claim Deed Form - This deed is commonly used in situations involving co-ownership among friends or business partners.

Quit Claim Deed Form Montana - While effective for simple transfers, it may not be the best choice for complex real estate situations.

Misconceptions

Understanding the South Carolina Quitclaim Deed form is essential for anyone involved in property transactions. However, several misconceptions exist about this legal document. Here are five common misunderstandings:

- A Quitclaim Deed Transfers Ownership Completely. Many believe that a quitclaim deed transfers full ownership of a property. In reality, it only transfers the interest the grantor has in the property, which may be none at all.

- Quitclaim Deeds Are Only for Family Transfers. While quitclaim deeds are often used among family members, they are not limited to such transactions. They can be used in various situations, including sales, divorces, or clearing up title issues.

- A Quitclaim Deed Guarantees Clear Title. Some people think that using a quitclaim deed guarantees a clear title. This is not the case. The deed does not provide any warranties or guarantees about the property’s title status.

- All States Use the Same Quitclaim Deed Format. It is a common misconception that quitclaim deeds are uniform across all states. Each state, including South Carolina, has specific requirements and formats that must be followed.

- Quitclaim Deeds Are Irrevocable. Many assume that once a quitclaim deed is executed, it cannot be changed or revoked. However, in certain situations, it may be possible to challenge or rescind the deed through legal means.

Being aware of these misconceptions can help individuals make informed decisions regarding property transactions in South Carolina.

PDF Form Details

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document used to transfer ownership of real estate from one person to another without any warranty of title. |

| Governing Law | In South Carolina, the use of quitclaim deeds is governed by South Carolina Code of Laws, Title 27, Chapter 7. |

| Purpose | This type of deed is commonly used to clear up title issues or to transfer property between family members. |

| No Warranty | Unlike other types of deeds, a quitclaim deed does not guarantee that the grantor has clear title to the property. |

| Parties Involved | The two main parties involved are the grantor (the person transferring the property) and the grantee (the person receiving the property). |

| Notarization | A quitclaim deed must be signed in the presence of a notary public to be considered valid. |

| Recording | To protect the interests of the grantee, the quitclaim deed should be recorded at the county register of deeds. |

| Tax Implications | While transferring property via a quitclaim deed, it’s important to be aware of potential tax implications, including gift taxes. |

| Use Cases | Quitclaim deeds are often used in divorce settlements, estate planning, and transferring property into or out of a trust. |

| Limitations | Due to the lack of warranties, quitclaim deeds are not typically used for traditional sales of property, where assurance of title is important. |

Key takeaways

When filling out and using the South Carolina Quitclaim Deed form, keep these key takeaways in mind:

- Ensure that the form is completed in black ink or typed to maintain legibility.

- Include the names and addresses of both the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Clearly describe the property being transferred, including the legal description as it appears in public records.

- Sign the deed in front of a notary public. This step is crucial for the document to be valid.

- Consider having the deed witnessed, although it is not a requirement in South Carolina.

- File the completed Quitclaim Deed with the county register of deeds office where the property is located.

- Pay any applicable recording fees at the time of filing to ensure the deed is officially recorded.

- Keep a copy of the recorded deed for your records after filing.

- Understand that a Quitclaim Deed transfers ownership without guaranteeing the title, which means the grantee takes the property "as is."

- Consult with a real estate attorney if you have questions about the implications of using a Quitclaim Deed.

South Carolina Quitclaim Deed Example

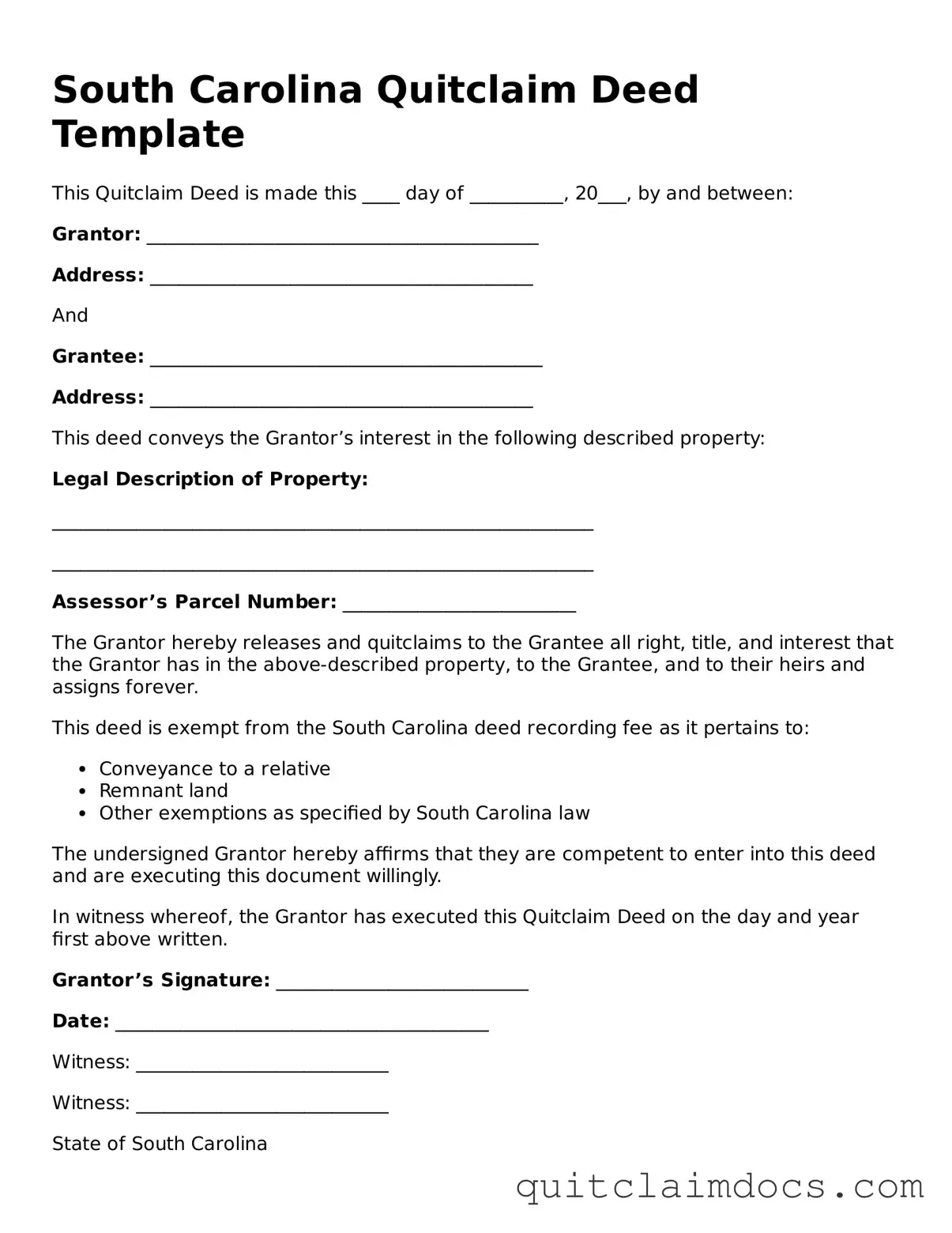

South Carolina Quitclaim Deed Template

This Quitclaim Deed is made this ____ day of __________, 20___, by and between:

Grantor: __________________________________________

Address: _________________________________________

And

Grantee: __________________________________________

Address: _________________________________________

This deed conveys the Grantor’s interest in the following described property:

Legal Description of Property:

__________________________________________________________

__________________________________________________________

Assessor’s Parcel Number: _________________________

The Grantor hereby releases and quitclaims to the Grantee all right, title, and interest that the Grantor has in the above-described property, to the Grantee, and to their heirs and assigns forever.

This deed is exempt from the South Carolina deed recording fee as it pertains to:

- Conveyance to a relative

- Remnant land

- Other exemptions as specified by South Carolina law

The undersigned Grantor hereby affirms that they are competent to enter into this deed and are executing this document willingly.

In witness whereof, the Grantor has executed this Quitclaim Deed on the day and year first above written.

Grantor’s Signature: ___________________________

Date: ________________________________________

Witness: ___________________________

Witness: ___________________________

State of South Carolina

County of ___________________________

Personally appeared before me, the undersigned notary public, the above-named Grantor, and acknowledged the due execution of the foregoing instrument.

Given under my hand and seal this ____ day of __________, 20___.

Notary Public

My Commission Expires: _______________

Dos and Don'ts

When filling out the South Carolina Quitclaim Deed form, it is essential to approach the process with care. Here are some key dos and don’ts to consider:

- Do ensure that all parties involved in the transaction are clearly identified.

- Do provide a complete and accurate legal description of the property.

- Do include the date of the transfer to establish a clear timeline.

- Do have the document notarized to validate the signatures.

- Don't leave any sections blank; this can lead to complications later.

- Don't forget to check local requirements, as they may vary.

- Don't use vague language; clarity is crucial in legal documents.

- Don't overlook the importance of recording the deed with the county clerk’s office.