Free Quitclaim Deed Template for Montana

Other Popular Quitclaim Deed State Templates

Massachusetts Quitclaim Deed - Ensure both parties are fully informed and agree to the terms of the Quitclaim Deed to avoid future conflicts.

Warranty Deed Nebraska - This type of deed is frequently used in divorce settlements to transfer property rights.

Quick Claim Deed Form Vermont - A Quitclaim Deed does not void prior claims to the property.

Quit Claim Deed Nh - In real estate transactions, a Quitclaim Deed is often used in conjunction with other legal documents.

Misconceptions

Understanding the Montana Quitclaim Deed form can be challenging due to several misconceptions. Here’s a list of common misunderstandings and clarifications to help you navigate this important legal document.

- A Quitclaim Deed transfers ownership without guarantees. Many people believe that a Quitclaim Deed guarantees clear title. In reality, it only transfers whatever interest the grantor has, if any, without any warranties.

- It is only used for property transfers between family members. While often used in family transactions, Quitclaim Deeds can also be utilized in various situations, including sales and transfers between unrelated parties.

- A Quitclaim Deed eliminates all liabilities. This is a misconception. The deed transfers ownership, but it does not remove any existing liens or debts attached to the property.

- Once signed, a Quitclaim Deed cannot be revoked. Although a Quitclaim Deed is generally irrevocable, the grantor can create a new deed to transfer the property back, if desired.

- All Quitclaim Deeds must be notarized. While notarization is highly recommended for validity and acceptance, Montana law does not explicitly require it for the deed to be effective.

- A Quitclaim Deed is the same as a Warranty Deed. This is incorrect. A Warranty Deed provides guarantees about the title, while a Quitclaim Deed does not offer any such assurances.

- Quitclaim Deeds are only for residential properties. This is a misconception. Quitclaim Deeds can be used for any type of real estate, including commercial properties and vacant land.

- You cannot use a Quitclaim Deed to add someone to the title. In fact, you can use a Quitclaim Deed to add another person to the title, transferring a portion of your interest in the property.

- Quitclaim Deeds are only for transferring property in Montana. Although this form is specific to Montana, Quitclaim Deeds are used in many states, each with its own regulations.

- Using a Quitclaim Deed is always the best option. While it is a useful tool, it may not be the best choice in every situation. Consulting with a legal professional is advisable to determine the most appropriate deed for your needs.

By understanding these misconceptions, individuals can make informed decisions when dealing with property transfers in Montana.

PDF Form Details

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document used to transfer ownership of real estate without any warranties regarding the title. |

| Governing Law | In Montana, quitclaim deeds are governed by Title 70, Chapter 21 of the Montana Code Annotated. |

| Purpose | This type of deed is often used between family members or in situations where the parties know each other well. |

| Transfer of Interest | A quitclaim deed transfers whatever interest the grantor has in the property, if any, to the grantee. |

| No Guarantees | Unlike warranty deeds, quitclaim deeds do not guarantee that the grantor has clear title to the property. |

| Common Uses | Quitclaim deeds are commonly used in divorce settlements, estate transfers, and to clear up title issues. |

| Filing Requirements | In Montana, the quitclaim deed must be signed by the grantor and notarized before it can be filed with the county clerk and recorder. |

| Tax Implications | While transferring property via a quitclaim deed may not incur immediate taxes, it is important to check for potential capital gains taxes. |

| Revocation | A quitclaim deed cannot be revoked once it has been executed and recorded, making it a permanent transfer. |

| Legal Advice | It's advisable to consult with a legal professional when using a quitclaim deed to ensure that all parties understand their rights and obligations. |

Key takeaways

When filling out and using the Montana Quitclaim Deed form, there are several important points to keep in mind. This document is essential for transferring property ownership. Here are key takeaways:

- Understand the Purpose: A Quitclaim Deed is used to transfer ownership of real estate without any warranties. It simply conveys whatever interest the grantor has in the property.

- Identify the Parties: Clearly list the names and addresses of both the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Provide a Legal Description: Include a detailed legal description of the property. This ensures clarity regarding the specific property being transferred.

- Signatures Required: The grantor must sign the deed in front of a notary public. This step is crucial for the document to be legally valid.

- Filing the Deed: After completing the form, file it with the county clerk and recorder's office in the county where the property is located. This step officially records the transfer.

- Consider Tax Implications: Be aware that transferring property may have tax consequences. Consulting a tax professional can provide guidance on potential liabilities.

- Retain Copies: Keep copies of the completed Quitclaim Deed for your records. This documentation can be important for future reference.

Following these key points can help ensure a smooth property transfer process in Montana.

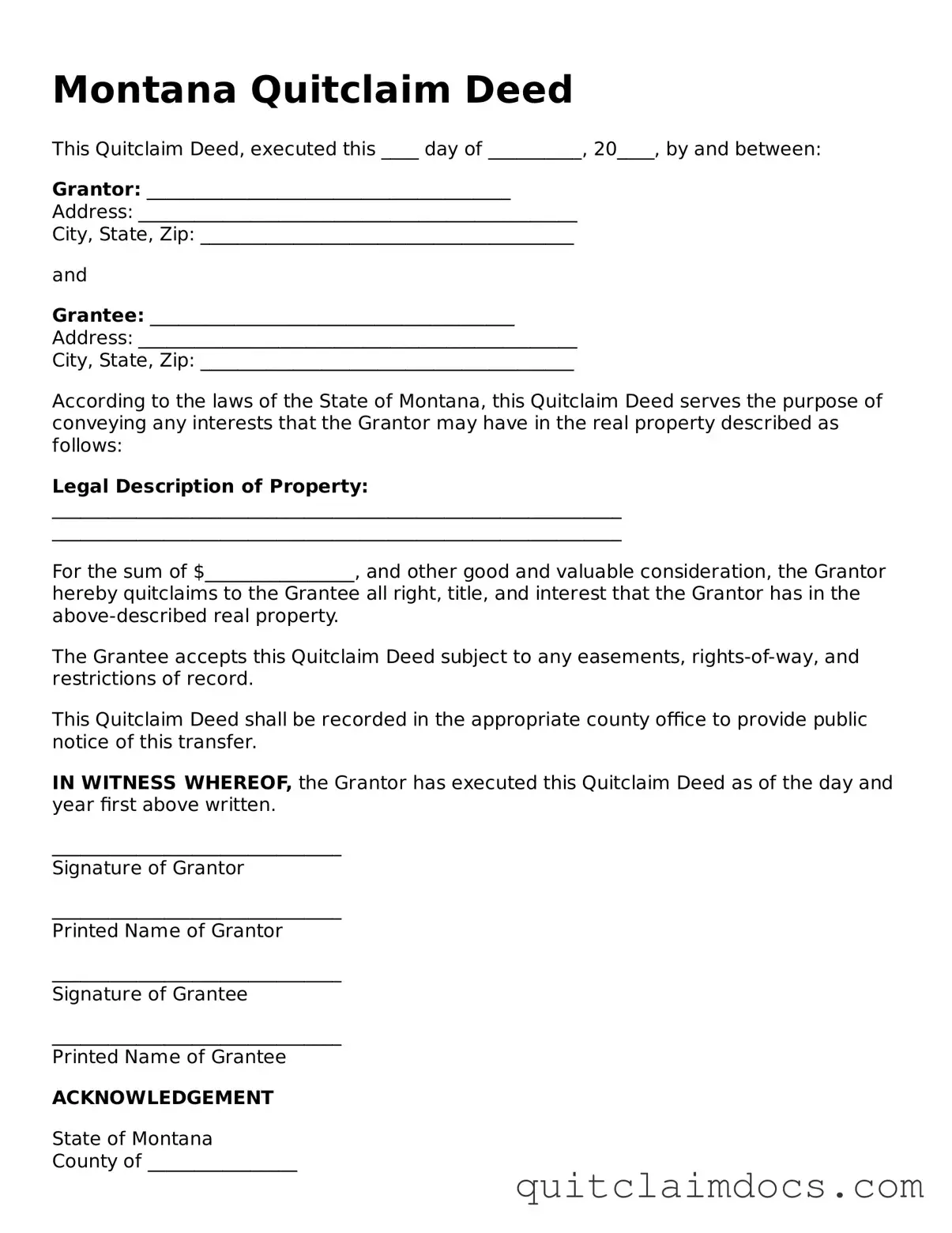

Montana Quitclaim Deed Example

Montana Quitclaim Deed

This Quitclaim Deed, executed this ____ day of __________, 20____, by and between:

Grantor: _______________________________________

Address: _______________________________________________

City, State, Zip: ________________________________________

and

Grantee: _______________________________________

Address: _______________________________________________

City, State, Zip: ________________________________________

According to the laws of the State of Montana, this Quitclaim Deed serves the purpose of conveying any interests that the Grantor may have in the real property described as follows:

Legal Description of Property:

_____________________________________________________________

_____________________________________________________________

For the sum of $________________, and other good and valuable consideration, the Grantor hereby quitclaims to the Grantee all right, title, and interest that the Grantor has in the above-described real property.

The Grantee accepts this Quitclaim Deed subject to any easements, rights-of-way, and restrictions of record.

This Quitclaim Deed shall be recorded in the appropriate county office to provide public notice of this transfer.

IN WITNESS WHEREOF, the Grantor has executed this Quitclaim Deed as of the day and year first above written.

_______________________________

Signature of Grantor

_______________________________

Printed Name of Grantor

_______________________________

Signature of Grantee

_______________________________

Printed Name of Grantee

ACKNOWLEDGEMENT

State of Montana

County of ________________

On this ____ day of __________, 20____, before me, a notary public in and for said state, personally appeared _______________________________ (Grantor) and_______________________________ (Grantee), to me known to be the person(s) described in and who executed the foregoing instrument, and acknowledged that they executed the same as their free and voluntary act.

Witness my hand and official seal.

_________________________________

Notary Public

My commission expires: _______________

Dos and Don'ts

When filling out the Montana Quitclaim Deed form, it's essential to follow certain guidelines to ensure accuracy and compliance. Here are seven things you should and shouldn't do:

- Do: Clearly identify the grantor and grantee. Include full names and addresses to avoid confusion.

- Do: Provide a complete legal description of the property. This information is crucial for accurately transferring ownership.

- Do: Sign the form in the presence of a notary public. A notarized signature adds validity to the document.

- Do: Check for any outstanding liens or encumbrances on the property before completing the deed.

- Don't: Leave any sections of the form blank. Incomplete forms can lead to delays or rejection.

- Don't: Use vague language when describing the property. Specificity is key to a clear transfer of ownership.

- Don't: Forget to record the deed with the county clerk and recorder after it has been signed and notarized.