Free Quitclaim Deed Template for Minnesota

Other Popular Quitclaim Deed State Templates

New Mexico Quit Claim Deed - A quitclaim deed is straightforward and user-friendly.

Quit Claim Deed Louisiana - It can include multiple grantors and grantees.

Quit Claim Deed Oregon - Suitable for dispossessing an interest in real estate.

Misconceptions

Understanding the Minnesota Quitclaim Deed form is crucial for anyone involved in real estate transactions. However, several misconceptions can lead to confusion and potential issues. Here are eight common misconceptions:

- A Quitclaim Deed Transfers Ownership Completely. Many believe that a quitclaim deed transfers full ownership rights. In reality, it only transfers whatever interest the grantor has, if any. If the grantor has no ownership, the grantee receives nothing.

- Quitclaim Deeds are Only for Family Transfers. While often used among family members, quitclaim deeds can be utilized in various situations, including sales between strangers or to clear title issues.

- Using a Quitclaim Deed is Always Simple. Although the form is straightforward, the implications can be complex. It's essential to understand the legal consequences and ensure that all parties are aware of their rights.

- A Quitclaim Deed Eliminates All Liabilities. Some people mistakenly think that transferring property via a quitclaim deed absolves them of any liabilities associated with that property. However, existing liens or mortgages remain attached to the property, regardless of ownership changes.

- Quitclaim Deeds are Only for Residential Properties. This form can be used for any type of property, including commercial real estate and land. Its versatility is one of its key features.

- Notarization is Optional for Quitclaim Deeds. In Minnesota, notarization is a requirement for a quitclaim deed to be legally binding. Failing to notarize can render the deed invalid.

- Quitclaim Deeds are Irrevocable. Many believe that once a quitclaim deed is executed, it cannot be undone. However, if both parties agree, the deed can be revoked or amended.

- Quitclaim Deeds are the Same as Warranty Deeds. These two types of deeds serve different purposes. A warranty deed provides guarantees about the title, while a quitclaim deed offers no such assurances.

Being aware of these misconceptions can help individuals navigate the complexities of property transfers more effectively. Always consider consulting a legal expert when dealing with real estate transactions to ensure a clear understanding of the process and its implications.

PDF Form Details

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed transfers ownership of property without guaranteeing that the title is clear. |

| Governing Law | In Minnesota, quitclaim deeds are governed by Minnesota Statutes, Chapter 507. |

| Use Cases | Commonly used in divorce settlements, property transfers between family members, or to clear up title issues. |

| Form Requirements | The form must be signed by the grantor in front of a notary public. |

| Recording | After signing, the deed must be recorded with the county recorder's office to be effective against third parties. |

| Consideration | While a quitclaim deed can be executed without payment, some consideration is typically stated in the document. |

| Limitations | A quitclaim deed does not protect the grantee from any existing liens or claims against the property. |

Key takeaways

When dealing with the Minnesota Quitclaim Deed form, it is essential to understand a few key points to ensure the process goes smoothly.

- Purpose of the Quitclaim Deed: This form is used to transfer ownership of real property from one party to another without guaranteeing the title's validity. It is often used in situations like divorce or transferring property to family members.

- Completing the Form: Accurate information is crucial. Include the names of both the grantor (the person transferring the property) and the grantee (the person receiving the property), along with a legal description of the property.

- Signing and Notarization: The form must be signed by the grantor in front of a notary public. This step is vital to ensure the deed is legally binding and can be recorded.

- Filing the Deed: After completion, the Quitclaim Deed should be filed with the county recorder’s office in the county where the property is located. This step officially updates the public record of ownership.

By following these guidelines, individuals can navigate the process of using a Quitclaim Deed with confidence.

Minnesota Quitclaim Deed Example

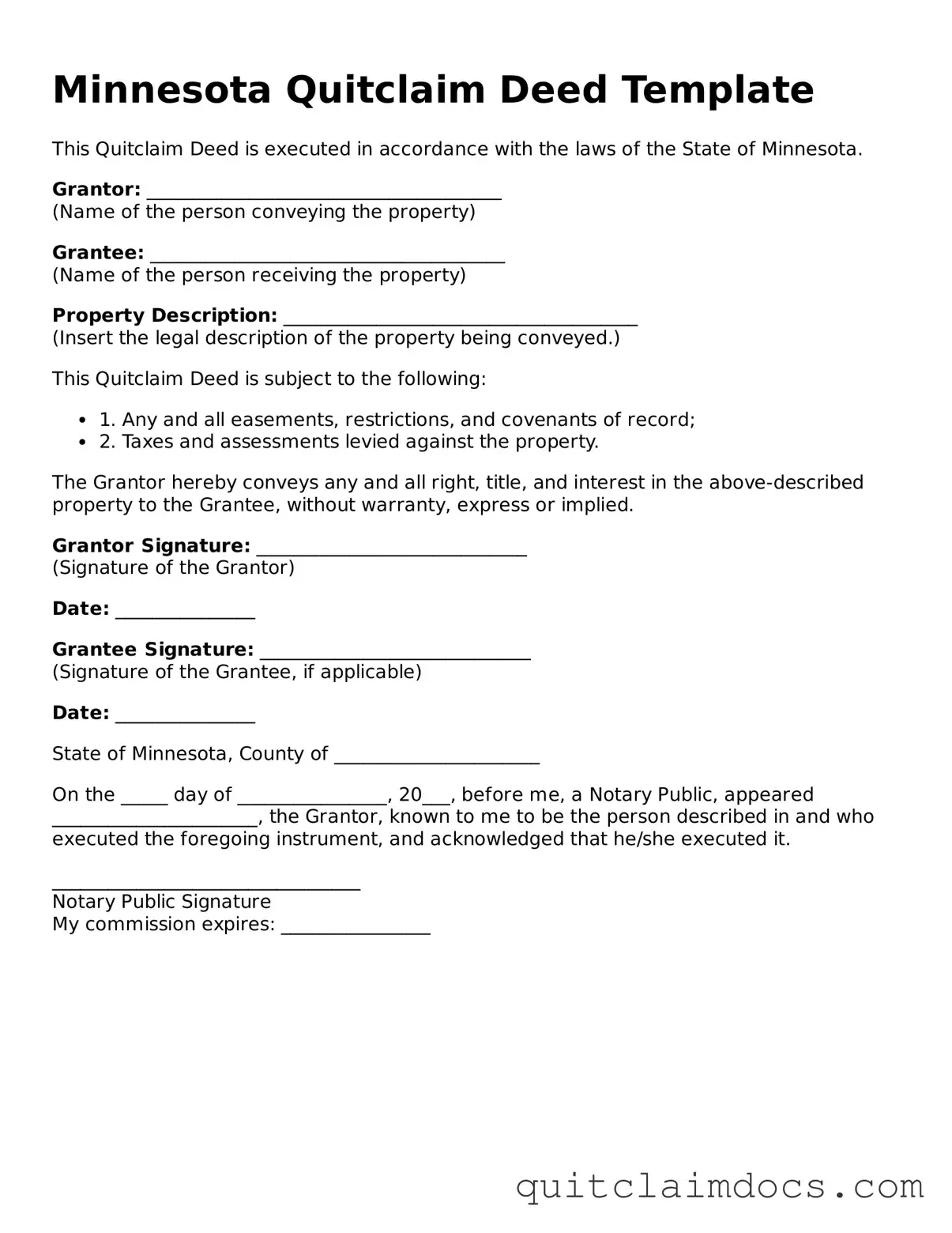

Minnesota Quitclaim Deed Template

This Quitclaim Deed is executed in accordance with the laws of the State of Minnesota.

Grantor: ______________________________________

(Name of the person conveying the property)

Grantee: ______________________________________

(Name of the person receiving the property)

Property Description: ______________________________________

(Insert the legal description of the property being conveyed.)

This Quitclaim Deed is subject to the following:

- 1. Any and all easements, restrictions, and covenants of record;

- 2. Taxes and assessments levied against the property.

The Grantor hereby conveys any and all right, title, and interest in the above-described property to the Grantee, without warranty, express or implied.

Grantor Signature: _____________________________

(Signature of the Grantor)

Date: _______________

Grantee Signature: _____________________________

(Signature of the Grantee, if applicable)

Date: _______________

State of Minnesota, County of ______________________

On the _____ day of ________________, 20___, before me, a Notary Public, appeared ______________________, the Grantor, known to me to be the person described in and who executed the foregoing instrument, and acknowledged that he/she executed it.

_________________________________

Notary Public Signature

My commission expires: ________________

Dos and Don'ts

When filling out the Minnesota Quitclaim Deed form, it’s important to approach the process carefully. Here are some dos and don’ts to guide you:

- Do ensure that all parties involved in the transfer are clearly identified.

- Do provide a complete legal description of the property being transferred.

- Do sign the deed in front of a notary public.

- Do check for any outstanding liens or mortgages on the property before signing.

- Don't leave any sections of the form blank; incomplete forms can lead to issues.

- Don't use the form for property transfers that require more formal documentation.

- Don't forget to file the deed with the county recorder’s office after completion.

- Don't rush through the process; take your time to ensure accuracy.