Free Quitclaim Deed Template for Kansas

Other Popular Quitclaim Deed State Templates

Quitclaim Meaning - This document can serve as a simple way to convey property between business partners.

How to Remove Someone From a Deed - Quitclaim Deeds can help clear titles marred by previous disputes or claims.

Illinois Quit Claim Deed Requirements - Once recorded, the Quitclaim Deed becomes part of the public property records.

New Jersey Deed Transfer Form - Always verify the legal age and competency of all parties involved when executing a Quitclaim Deed.

Misconceptions

The Kansas Quitclaim Deed is often misunderstood. Here are ten common misconceptions about this legal document:

-

A Quitclaim Deed transfers ownership of property.

This is partially true. A Quitclaim Deed transfers whatever interest the grantor has in the property, but it does not guarantee that the grantor actually owns the property.

-

Quitclaim Deeds are only for divorces or family transfers.

While they are commonly used in these situations, Quitclaim Deeds can be used for any type of property transfer.

-

A Quitclaim Deed provides warranty of title.

This is false. A Quitclaim Deed offers no warranties. The grantee receives whatever interest the grantor has, if any.

-

All states use the same Quitclaim Deed format.

This is incorrect. Each state has its own requirements and formats for Quitclaim Deeds, including Kansas.

-

You don’t need to record a Quitclaim Deed.

While it is not mandatory, recording the deed is important. It protects the grantee's interest and provides public notice of ownership.

-

Quitclaim Deeds can only be used for residential property.

This is a misconception. Quitclaim Deeds can be used for any type of real estate, including commercial properties.

-

A Quitclaim Deed eliminates all liens on the property.

This is not true. Liens remain attached to the property, regardless of the type of deed used.

-

You can’t use a Quitclaim Deed if there’s a mortgage on the property.

This is misleading. A Quitclaim Deed can still be used, but the mortgage remains the responsibility of the original borrower.

-

Quitclaim Deeds are only valid if notarized.

While notarization is recommended, the validity of a Quitclaim Deed may still hold even if it is not notarized, depending on state law.

-

Once a Quitclaim Deed is signed, it cannot be revoked.

This is incorrect. A Quitclaim Deed can be revoked, but the process may require additional legal steps.

Understanding these misconceptions can help clarify the role and limitations of a Kansas Quitclaim Deed. Always consider seeking legal advice when dealing with property transfers.

PDF Form Details

| Fact Name | Details |

|---|---|

| Definition | A Kansas Quitclaim Deed is a legal document that transfers ownership of real estate from one party to another without any warranties regarding the title. |

| Governing Law | The Kansas Quitclaim Deed is governed by the Kansas Statutes Annotated, specifically K.S.A. 58-2201 et seq. |

| Parties Involved | The document involves at least two parties: the grantor (the person transferring the property) and the grantee (the person receiving the property). |

| Consideration | While a monetary consideration is common, it is not required. The deed can be executed for a nominal amount or even as a gift. |

| Notarization Requirement | A Quitclaim Deed in Kansas must be notarized to be valid. This ensures that the identities of the parties are verified. |

| Recording | To provide public notice of the transfer, the deed should be recorded with the county register of deeds where the property is located. |

| Limitations | The Quitclaim Deed does not guarantee that the grantor has valid title to the property. It simply transfers whatever interest the grantor may have. |

| Use Cases | This type of deed is often used among family members, in divorce settlements, or to clear up title issues. |

Key takeaways

When dealing with property transfers in Kansas, understanding the Quitclaim Deed form is essential. Here are some key takeaways to consider:

- The Quitclaim Deed allows one party to transfer their interest in a property to another party without guaranteeing that the title is clear.

- This form is often used among family members or in situations where the parties know each other well, as it carries less risk than other types of deeds.

- To be valid, the Quitclaim Deed must be signed by the grantor (the person transferring the property) in the presence of a notary public.

- It is advisable to include a legal description of the property being transferred to avoid any confusion or disputes in the future.

- Once completed, the Quitclaim Deed should be filed with the appropriate county office to ensure the transfer is officially recorded.

- There may be fees associated with filing the deed, so it's important to check with the local county clerk for specific costs.

- Consulting with a legal professional can provide clarity and ensure that all necessary steps are followed during the transfer process.

Kansas Quitclaim Deed Example

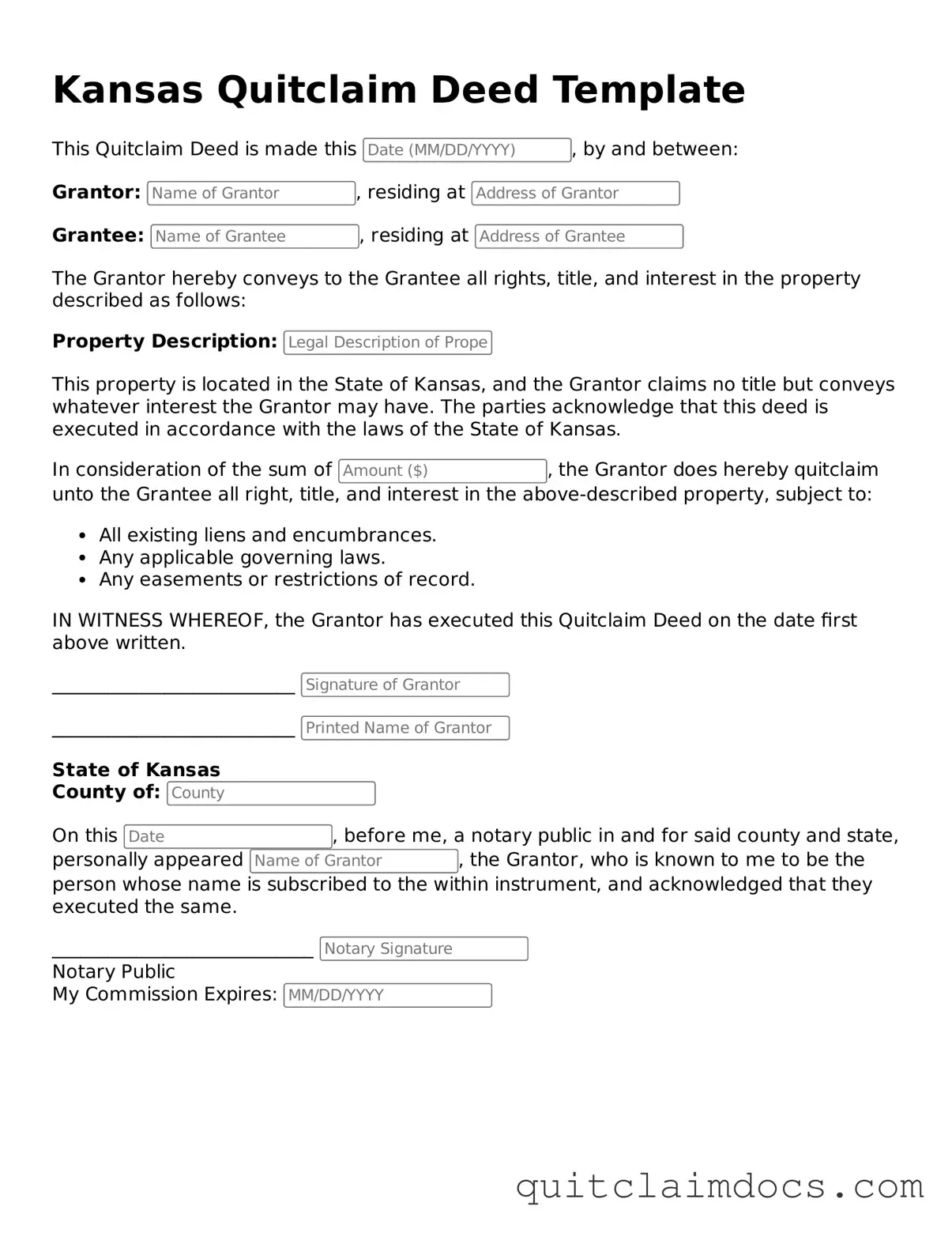

Kansas Quitclaim Deed Template

This Quitclaim Deed is made this , by and between:

Grantor: , residing at

Grantee: , residing at

The Grantor hereby conveys to the Grantee all rights, title, and interest in the property described as follows:

Property Description:

This property is located in the State of Kansas, and the Grantor claims no title but conveys whatever interest the Grantor may have. The parties acknowledge that this deed is executed in accordance with the laws of the State of Kansas.

In consideration of the sum of , the Grantor does hereby quitclaim unto the Grantee all right, title, and interest in the above-described property, subject to:

- All existing liens and encumbrances.

- Any applicable governing laws.

- Any easements or restrictions of record.

IN WITNESS WHEREOF, the Grantor has executed this Quitclaim Deed on the date first above written.

__________________________

__________________________

State of Kansas

County of:

On this , before me, a notary public in and for said county and state, personally appeared , the Grantor, who is known to me to be the person whose name is subscribed to the within instrument, and acknowledged that they executed the same.

____________________________

Notary Public

My Commission Expires:

Dos and Don'ts

When filling out the Kansas Quitclaim Deed form, it’s important to follow certain guidelines to ensure the document is valid and serves its intended purpose. Here’s a helpful list of dos and don’ts:

- Do provide accurate information about the property being transferred.

- Do include the full names of both the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Do ensure the form is signed in the presence of a notary public.

- Do check for any specific local requirements that may apply to your county.

- Don't leave any sections of the form blank; all relevant fields must be completed.

- Don't use unclear or ambiguous language when describing the property.

- Don't forget to date the document when signing.

- Don't file the deed without first making copies for your records.