Free Quitclaim Deed Template for Illinois

Other Popular Quitclaim Deed State Templates

Quick Deed Tennessee - A Quitclaim Deed may help clear up ownership disputes.

Quit Claim Deed Oregon - This form is simple and easy to complete.

Quitclaim Meaning - A Quitclaim Deed can be useful in divorce settlements when dividing property.

Misconceptions

The Illinois Quitclaim Deed is often misunderstood. Here are six common misconceptions that people have about this legal document:

- It transfers ownership without any warranties. Many believe that a quitclaim deed offers guarantees about the property’s title. In reality, it only transfers whatever interest the grantor has, if any, without any assurances.

- It is only used between family members. While quitclaim deeds are frequently used among relatives, they are not limited to familial transactions. Anyone can use a quitclaim deed to transfer property to another person.

- It is the same as a warranty deed. Some think that quitclaim deeds and warranty deeds serve the same purpose. However, a warranty deed provides a guarantee of clear title, while a quitclaim deed does not.

- It is a complicated legal document. Many people feel intimidated by the quitclaim deed form. In truth, it is relatively straightforward and can be completed without extensive legal knowledge.

- It cannot be used for real estate transactions. A common belief is that quitclaim deeds are unsuitable for real estate. In fact, they are often used for real estate transfers, especially in situations involving family or simple ownership changes.

- Once signed, it cannot be revoked. Some assume that a quitclaim deed is final and cannot be undone. While it does transfer ownership, the grantor may have options to challenge the deed or take further legal action if there are grounds to do so.

Understanding these misconceptions can help individuals make informed decisions when dealing with property transfers in Illinois.

PDF Form Details

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document used to transfer ownership of real estate without any warranties or guarantees. |

| Governing Law | The Illinois Quitclaim Deed is governed by the Illinois Compiled Statutes, specifically 765 ILCS 1005. |

| Parties Involved | The document involves two parties: the grantor (seller) and the grantee (buyer). |

| Consideration | While a monetary consideration is often included, it is not required for the deed to be valid. |

| Notarization Requirement | The quitclaim deed must be signed in the presence of a notary public to be legally binding. |

| Recording | To provide public notice of the transfer, the deed should be recorded with the county recorder’s office. |

| Use Cases | Commonly used for transferring property between family members or clearing up title issues. |

| Limitations | The quitclaim deed does not guarantee that the grantor holds clear title to the property. |

Key takeaways

Filling out and using the Illinois Quitclaim Deed form is an important step in transferring property ownership. Here are some key takeaways to keep in mind:

- Understand the Purpose: A Quitclaim Deed transfers interest in a property from one party to another without guaranteeing that the title is clear.

- Gather Necessary Information: Before filling out the form, collect all required details such as the names of the grantor and grantee, property description, and any relevant identification numbers.

- Complete the Form Accurately: Ensure that all information is filled out correctly. Mistakes can lead to delays or complications in the transfer process.

- Signatures Are Essential: Both the grantor and grantee must sign the deed. In Illinois, the grantor's signature must be notarized.

- File with the County: After completing the Quitclaim Deed, it must be filed with the county recorder's office where the property is located to make the transfer official.

- Consider Legal Assistance: While it’s possible to complete the form on your own, consulting with a lawyer can help ensure that the deed is executed properly and meets all legal requirements.

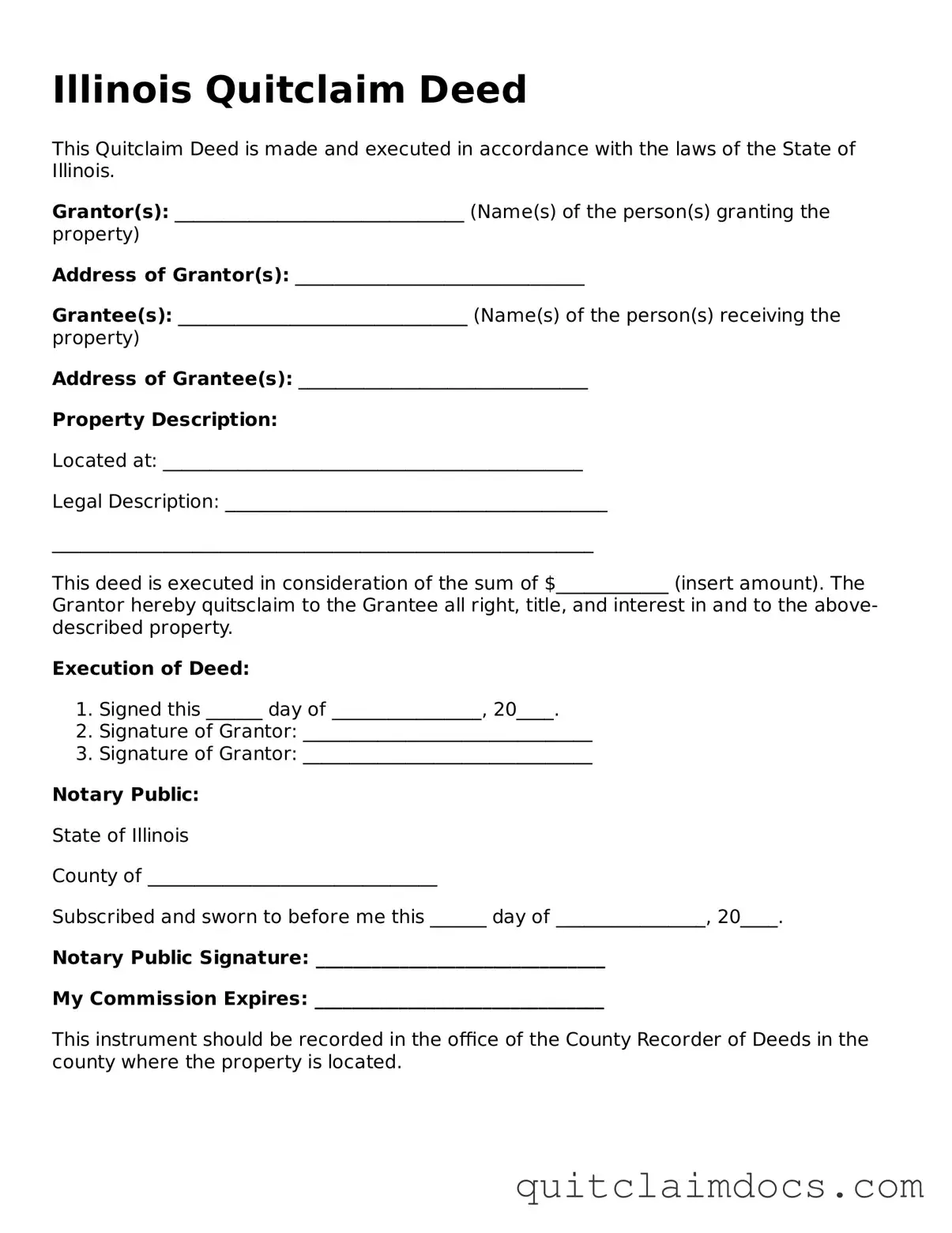

Illinois Quitclaim Deed Example

Illinois Quitclaim Deed

This Quitclaim Deed is made and executed in accordance with the laws of the State of Illinois.

Grantor(s): _______________________________ (Name(s) of the person(s) granting the property)

Address of Grantor(s): _______________________________

Grantee(s): _______________________________ (Name(s) of the person(s) receiving the property)

Address of Grantee(s): _______________________________

Property Description:

Located at: _____________________________________________

Legal Description: _________________________________________

__________________________________________________________

This deed is executed in consideration of the sum of $____________ (insert amount). The Grantor hereby quitsclaim to the Grantee all right, title, and interest in and to the above-described property.

Execution of Deed:

- Signed this ______ day of ________________, 20____.

- Signature of Grantor: _______________________________

- Signature of Grantor: _______________________________

Notary Public:

State of Illinois

County of _______________________________

Subscribed and sworn to before me this ______ day of ________________, 20____.

Notary Public Signature: _______________________________

My Commission Expires: _______________________________

This instrument should be recorded in the office of the County Recorder of Deeds in the county where the property is located.

Dos and Don'ts

Filling out the Illinois Quitclaim Deed form can be straightforward if you keep a few key points in mind. Here’s a handy list of dos and don’ts to help you navigate the process smoothly.

- Do ensure that all parties involved in the transaction are clearly identified.

- Do provide a complete legal description of the property being transferred.

- Do sign the form in the presence of a notary public.

- Do double-check for any errors or omissions before submitting the form.

- Don't leave any sections blank; incomplete forms can lead to delays.

- Don't forget to include the appropriate filing fee when submitting the deed.

- Don't assume that a Quitclaim Deed automatically guarantees clear title; it merely transfers interest.

By following these guidelines, you can help ensure that your Quitclaim Deed is completed correctly and efficiently. Happy filing!