Free Quitclaim Deed Template for Hawaii

Other Popular Quitclaim Deed State Templates

New Mexico Quit Claim Deed - No warranties are provided with a quitclaim deed.

Arizona Quit Claim Deed Form - The form does not convey any promises about the property's condition.

Misconceptions

When it comes to the Hawaii Quitclaim Deed form, there are several misconceptions that people often have. Understanding these can help clarify the purpose and implications of this document. Below are six common misconceptions:

- A Quitclaim Deed is the same as a Warranty Deed. This is not true. A Quitclaim Deed transfers whatever interest the grantor has in the property without guaranteeing that the title is clear. In contrast, a Warranty Deed provides a guarantee that the title is free of defects.

- You cannot use a Quitclaim Deed for property transfers between family members. This is a misconception. Quitclaim Deeds are often used among family members, especially for transferring property without the complexities of a sale.

- A Quitclaim Deed eliminates all liabilities associated with the property. This is misleading. While the deed transfers ownership, it does not absolve the grantor of any outstanding debts or liens on the property.

- You don’t need to record a Quitclaim Deed. Many believe that recording is optional, but it is highly recommended. Recording the deed with the county helps protect the new owner's rights and provides public notice of the transfer.

- A Quitclaim Deed is only for real estate transactions. This is incorrect. While it is most commonly used for real estate, a Quitclaim Deed can also be used for other types of property, such as vehicles or personal property.

- You can use a Quitclaim Deed to transfer property without the other party's consent. This is a misconception. The grantor must have the authority to transfer the property, and both parties should ideally agree to the transaction.

By addressing these misconceptions, individuals can better understand the role of a Quitclaim Deed in property transfers and make informed decisions when handling their real estate matters in Hawaii.

PDF Form Details

| Fact Name | Detail |

|---|---|

| Definition | A quitclaim deed is a legal document used to transfer ownership of real estate without any warranties or guarantees. |

| Governing Law | The Hawaii Quitclaim Deed is governed by Hawaii Revised Statutes, Chapter 501. |

| Purpose | This form is often used to transfer property between family members or to clear up title issues. |

| Consideration | While consideration is not required, it is common to include a nominal amount, such as $1. |

| Signature Requirements | The deed must be signed by the grantor (the person transferring the property) in front of a notary public. |

| Recording | To be effective against third parties, the quitclaim deed must be recorded with the Bureau of Conveyances in Hawaii. |

| Tax Implications | Transfer taxes may apply when a quitclaim deed is executed, depending on the value of the property transferred. |

| Revocation | A quitclaim deed cannot be revoked unilaterally once it has been executed and recorded. |

| Limitations | This type of deed does not protect the grantee (the person receiving the property) from claims against the property. |

| Common Uses | Quitclaim deeds are frequently used in divorce settlements, estate planning, and transferring property into trusts. |

Key takeaways

When dealing with property transfers in Hawaii, using a Quitclaim Deed can be a straightforward process. Here are some key takeaways to keep in mind when filling out and using the Hawaii Quitclaim Deed form:

- Understand the Purpose: A Quitclaim Deed is primarily used to transfer ownership of property without making any guarantees about the title. This means the grantor is not assuring the grantee that the property is free from liens or other claims.

- Gather Necessary Information: Before filling out the form, ensure you have all relevant details, such as the full names of the parties involved, the property description, and the signature of the grantor.

- Signatures Matter: The deed must be signed by the grantor in front of a notary public. This step is crucial as it validates the transfer of ownership.

- File with the Appropriate Office: After completing the Quitclaim Deed, it should be filed with the Bureau of Conveyances in Hawaii. This step ensures that the property transfer is recorded and legally recognized.

- Consider Legal Advice: While a Quitclaim Deed can be simple, it’s wise to consult with a legal professional to understand any implications, especially if there are existing liens or disputes regarding the property.

By keeping these points in mind, you can navigate the Quitclaim Deed process more effectively and ensure a smoother property transfer in Hawaii.

Hawaii Quitclaim Deed Example

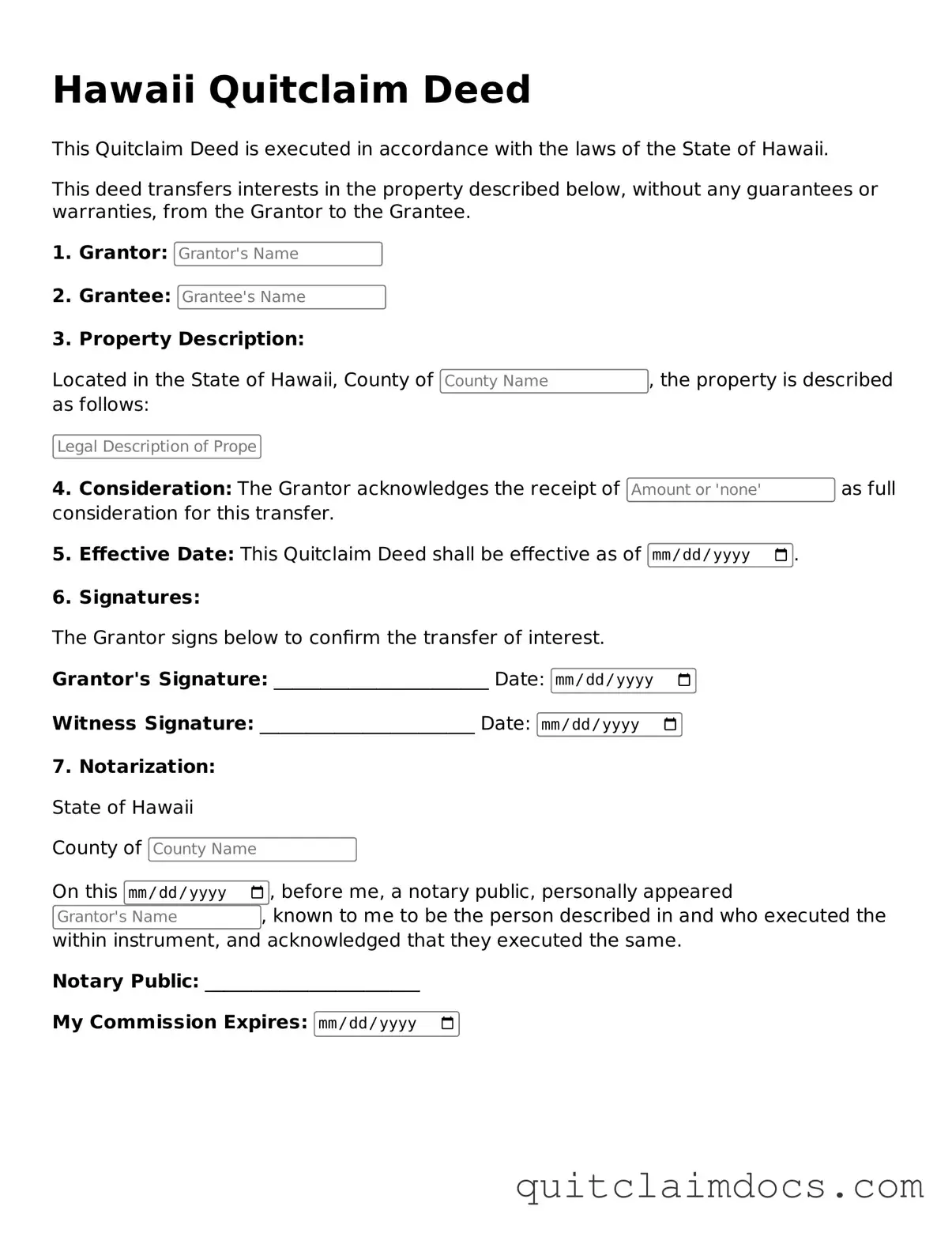

Hawaii Quitclaim Deed

This Quitclaim Deed is executed in accordance with the laws of the State of Hawaii.

This deed transfers interests in the property described below, without any guarantees or warranties, from the Grantor to the Grantee.

1. Grantor:

2. Grantee:

3. Property Description:

Located in the State of Hawaii, County of , the property is described as follows:

4. Consideration: The Grantor acknowledges the receipt of as full consideration for this transfer.

5. Effective Date: This Quitclaim Deed shall be effective as of .

6. Signatures:

The Grantor signs below to confirm the transfer of interest.

Grantor's Signature: _______________________ Date:

Witness Signature: _______________________ Date:

7. Notarization:

State of Hawaii

County of

On this , before me, a notary public, personally appeared , known to me to be the person described in and who executed the within instrument, and acknowledged that they executed the same.

Notary Public: _______________________

My Commission Expires:

Dos and Don'ts

When filling out the Hawaii Quitclaim Deed form, it is important to follow certain guidelines to ensure accuracy and compliance. Here are five things you should and shouldn't do:

- Do double-check the names of all parties involved. Ensure that they are spelled correctly and match the names on legal documents.

- Don't leave any required fields blank. Every section of the form must be completed to avoid delays in processing.

- Do provide a clear description of the property being transferred. Include details such as the address and parcel number.

- Don't use abbreviations or shorthand. Write out all terms fully to prevent any misunderstandings.

- Do sign the form in front of a notary public. This step is crucial for the validity of the deed.