Free Quitclaim Deed Template for Georgia

Other Popular Quitclaim Deed State Templates

Quick Deed Tennessee - It provides a simple way to transfer property among trusted individuals.

Quit Claim Deed Wyoming - This form is recognized in all 50 states across the U.S.

Oklahoma Quick Claim Deed - Property owners should understand that this deed does not shield against future claims or liens.

North Carolina Quit Claim Deed Pdf - A Quitclaim Deed does not reflect any financial considerations, meaning it can be issued for little or no payment.

Misconceptions

Many individuals encounter misconceptions when it comes to the Georgia Quitclaim Deed form. Understanding these common misunderstandings can help clarify the purpose and implications of using this type of deed.

- Misconception 1: A quitclaim deed transfers ownership of property.

- Misconception 2: Quitclaim deeds are only used in divorce cases.

- Misconception 3: A quitclaim deed offers legal protection against claims.

- Misconception 4: You do not need to record a quitclaim deed.

- Misconception 5: Quitclaim deeds are the same as warranty deeds.

- Misconception 6: All quitclaim deeds must be notarized.

- Misconception 7: A quitclaim deed can be used to eliminate a mortgage.

This is only partially true. A quitclaim deed does transfer any interest the grantor may have in the property, but it does not guarantee that the grantor actually owns the property or has clear title.

While they are often used to transfer property between spouses during a divorce, quitclaim deeds can also be used in other situations, such as transferring property between family members or to clear up title issues.

This is misleading. A quitclaim deed does not protect the grantee from any future claims or liens against the property. It simply transfers whatever interest the grantor has.

While it is not legally required to record a quitclaim deed, failing to do so can lead to complications. Recording the deed provides public notice of the ownership change and protects the grantee’s rights.

This is incorrect. A warranty deed provides guarantees about the title and the grantor's ownership, while a quitclaim deed does not provide any warranties or guarantees.

In Georgia, while it is highly recommended to have a quitclaim deed notarized to ensure its validity, it is not a strict requirement for the deed to be effective.

This is a misunderstanding. A quitclaim deed does not remove a mortgage or any liens on the property. The mortgage remains attached to the property regardless of ownership changes.

PDF Form Details

| Fact Name | Details |

|---|---|

| Definition | A quitclaim deed is a legal document used to transfer ownership of real estate without any guarantees about the title's quality. |

| Governing Law | The use of quitclaim deeds in Georgia is governed by the Official Code of Georgia Annotated (OCGA) § 44-5-30. |

| No Warranty | Unlike warranty deeds, a quitclaim deed offers no warranties or guarantees. The grantor simply transfers whatever interest they may have. |

| Common Uses | Quitclaim deeds are often used in divorce settlements, transferring property between family members, or clearing up title issues. |

| Filing Requirements | To be valid, the quitclaim deed must be signed by the grantor and recorded with the local county clerk’s office in Georgia. |

| Tax Implications | While quitclaim deeds do not typically incur transfer taxes, it’s advisable to consult with a tax professional regarding potential implications. |

Key takeaways

Filling out and using a Georgia Quitclaim Deed form requires careful attention to detail. Here are ten key takeaways to consider:

- Understand the Purpose: A Quitclaim Deed is primarily used to transfer ownership of property without guaranteeing the title's validity. This means the grantor is not liable for any claims against the property.

- Identify the Parties: Clearly state the names of both the grantor (the person transferring the property) and the grantee (the person receiving the property). Ensure that the names are spelled correctly.

- Property Description: Provide a complete legal description of the property being transferred. This is often found in previous deeds or property tax documents.

- Consider Notarization: While not always required, having the Quitclaim Deed notarized can add an extra layer of authenticity and may be necessary for recording purposes.

- File with the County: After completing the form, it must be filed with the county clerk's office where the property is located. This step is crucial for the transfer to be legally recognized.

- Check for Fees: Be aware that there may be filing fees associated with recording the Quitclaim Deed. These fees can vary by county.

- Use Clear Language: Avoid ambiguous terms or phrases in the deed. Clarity helps prevent future disputes over property ownership.

- Consult Legal Advice: If there are any uncertainties about the process or the implications of using a Quitclaim Deed, consulting a real estate attorney is advisable.

- Tax Implications: Understand that transferring property can have tax implications. Consulting a tax professional can provide guidance on any potential liabilities.

- Keep Copies: After the Quitclaim Deed is filed, retain copies for personal records. This documentation may be needed for future reference or transactions.

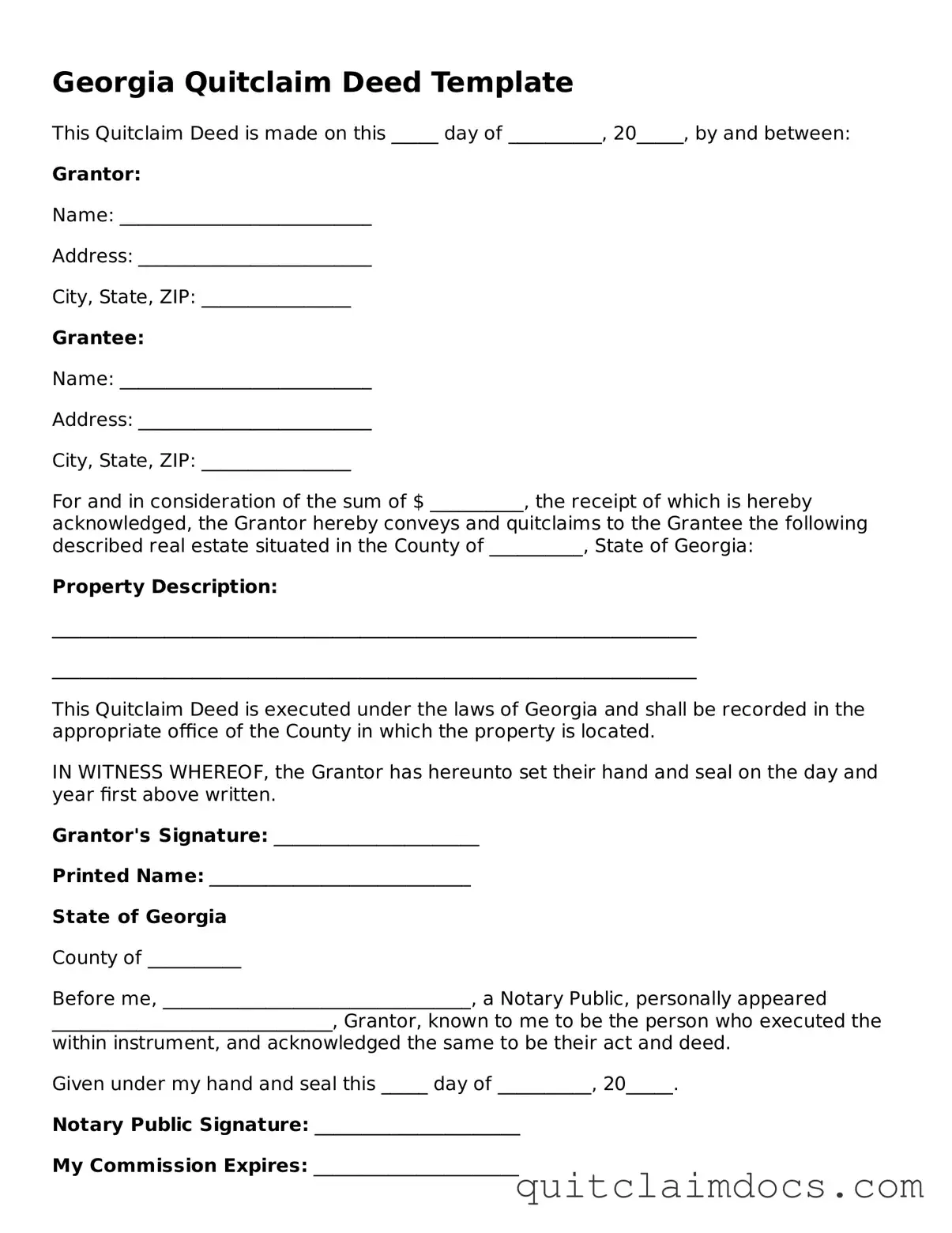

Georgia Quitclaim Deed Example

Georgia Quitclaim Deed Template

This Quitclaim Deed is made on this _____ day of __________, 20_____, by and between:

Grantor:

Name: ___________________________

Address: _________________________

City, State, ZIP: ________________

Grantee:

Name: ___________________________

Address: _________________________

City, State, ZIP: ________________

For and in consideration of the sum of $ __________, the receipt of which is hereby acknowledged, the Grantor hereby conveys and quitclaims to the Grantee the following described real estate situated in the County of __________, State of Georgia:

Property Description:

_____________________________________________________________________

_____________________________________________________________________

This Quitclaim Deed is executed under the laws of Georgia and shall be recorded in the appropriate office of the County in which the property is located.

IN WITNESS WHEREOF, the Grantor has hereunto set their hand and seal on the day and year first above written.

Grantor's Signature: ______________________

Printed Name: ____________________________

State of Georgia

County of __________

Before me, _________________________________, a Notary Public, personally appeared ______________________________, Grantor, known to me to be the person who executed the within instrument, and acknowledged the same to be their act and deed.

Given under my hand and seal this _____ day of __________, 20_____.

Notary Public Signature: ______________________

My Commission Expires: ______________________

Dos and Don'ts

When filling out the Georgia Quitclaim Deed form, it’s important to approach the process with care. Here’s a list of things you should and shouldn’t do to ensure that the deed is completed correctly.

- Do provide accurate information for both the grantor and grantee. Double-check names and addresses to avoid any errors.

- Do include a legal description of the property. This helps to clearly identify the property being transferred.

- Do sign the form in the presence of a notary public. A signature without notarization may render the deed invalid.

- Do file the completed deed with the county clerk’s office. This step is crucial for the deed to be legally recognized.

- Do keep a copy of the completed deed for your records. It’s important to have documentation of the transaction.

- Don’t leave any required fields blank. Missing information can lead to complications or rejection of the deed.

- Don’t use outdated forms. Ensure you have the most current version of the Quitclaim Deed form.

- Don’t forget to check for any local requirements. Some counties may have additional regulations for filing deeds.

- Don’t rush through the process. Take your time to ensure everything is filled out correctly.

- Don’t assume that a Quitclaim Deed is the same as a warranty deed. Understand the differences to make informed decisions.