Free Quitclaim Deed Template for Connecticut

Other Popular Quitclaim Deed State Templates

Quit Claim Deed Form Maine - Quitclaim Deeds do not protect against claims from unknown creditors.

Quit Claim Deed Indiana Form Pdf - This form conveys whatever interest the grantor has in the property to the grantee.

Misconceptions

Many people hold misconceptions about the Connecticut Quitclaim Deed form. Understanding these can help clarify its purpose and function. Below are seven common misconceptions:

- Quitclaim Deeds Transfer Ownership Automatically: A quitclaim deed does not automatically transfer ownership. It simply conveys whatever interest the grantor has in the property, which may be none at all.

- Quitclaim Deeds Provide Warranty of Title: Unlike warranty deeds, quitclaim deeds do not guarantee that the grantor has a valid title. The grantee accepts the property "as is," with no assurances.

- Quitclaim Deeds Are Only for Transfers Between Family Members: While often used among family, quitclaim deeds can be used in various situations, including sales and transfers between strangers.

- All States Use the Same Quitclaim Deed Format: Each state, including Connecticut, has specific requirements and formats for quitclaim deeds. It's essential to follow local laws.

- Quitclaim Deeds Eliminate Liens: A quitclaim deed does not remove existing liens or encumbrances on the property. The new owner may still be responsible for these debts.

- Quitclaim Deeds Are Irrevocable: A quitclaim deed can be revoked if both parties agree. However, revocation must follow legal procedures to be valid.

- Quitclaim Deeds Require Notarization: While notarization is common, it is not always legally required for a quitclaim deed to be valid in Connecticut. However, it is highly recommended for authenticity.

Addressing these misconceptions can help individuals make informed decisions regarding property transfers in Connecticut.

PDF Form Details

| Fact Name | Description |

|---|---|

| Definition | A Quitclaim Deed transfers ownership interest in a property without any warranties regarding the title. |

| Governing Law | The Connecticut Quitclaim Deed is governed by Connecticut General Statutes, Section 47-36a. |

| Parties Involved | The deed involves a grantor (the person transferring the property) and a grantee (the person receiving the property). |

| Use Cases | Commonly used in divorce settlements, property transfers between family members, or to clear up title issues. |

| Form Requirements | The form must be signed by the grantor and notarized to be legally valid in Connecticut. |

| Recording | To protect the grantee's interest, the deed should be recorded at the local town clerk's office. |

| Tax Implications | No state transfer tax is due when filing a Quitclaim Deed in Connecticut, but local fees may apply. |

| Limitations | The Quitclaim Deed does not guarantee that the grantor has clear title to the property, which can lead to potential disputes. |

Key takeaways

Understand that a Quitclaim Deed transfers ownership of property without guaranteeing that the title is clear. This means the seller does not promise that there are no claims against the property.

Obtain the correct form for the Connecticut Quitclaim Deed. Ensure it is the most current version available.

Fill out the form completely. Include the names of both the grantor (seller) and grantee (buyer), along with their addresses.

Clearly describe the property being transferred. Include the property address and any relevant legal description.

Sign the form in front of a notary public. This step is crucial for the deed to be legally binding.

Check for any local requirements. Some municipalities may have additional regulations regarding property transfers.

File the completed Quitclaim Deed with the appropriate town clerk’s office. This step officially records the transfer of ownership.

Be aware of any applicable fees associated with filing the Quitclaim Deed. These fees vary by location.

Keep a copy of the filed Quitclaim Deed for your records. This serves as proof of ownership transfer.

Consult a real estate attorney if you have questions or concerns about the process. Legal advice can help avoid future complications.

Connecticut Quitclaim Deed Example

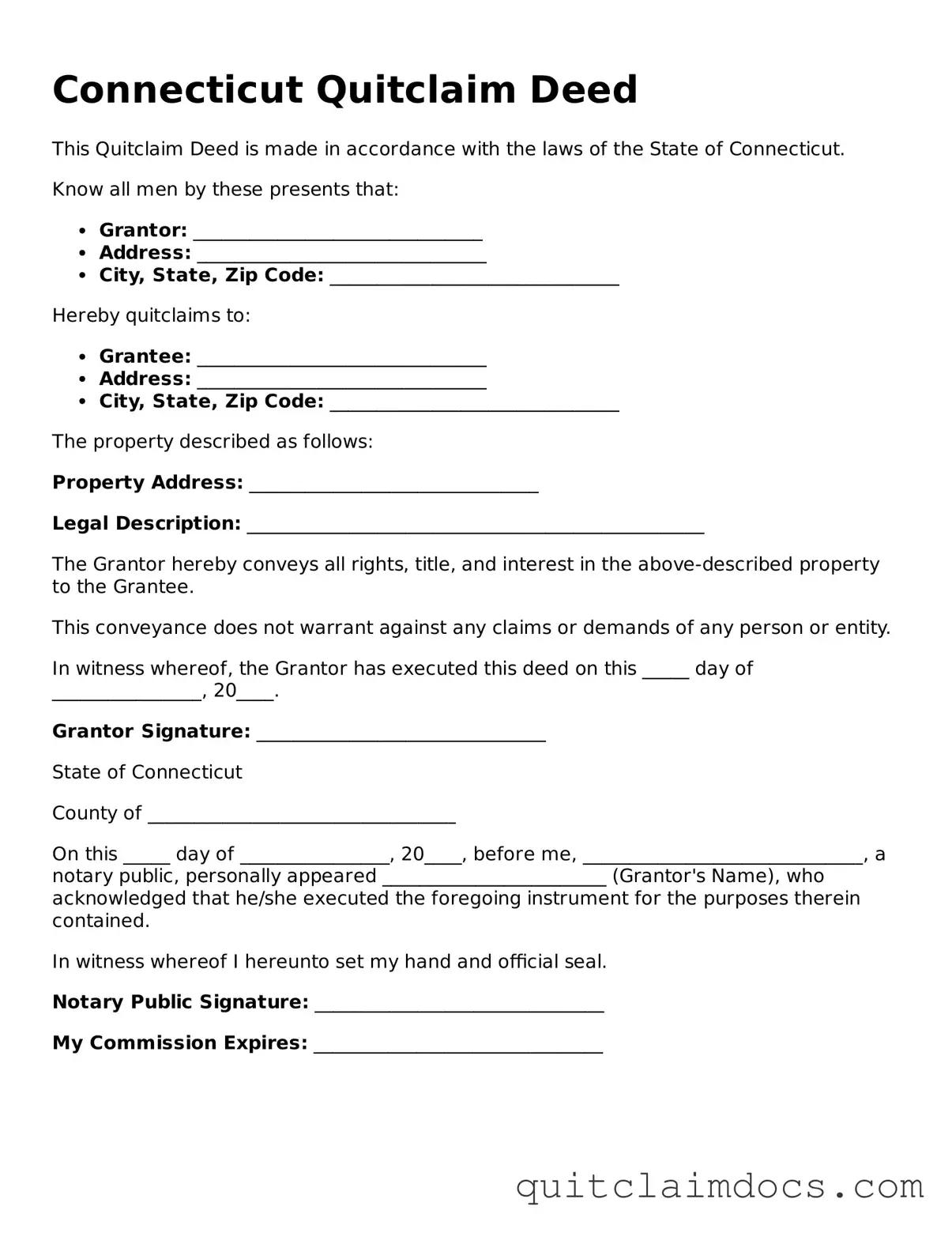

Connecticut Quitclaim Deed

This Quitclaim Deed is made in accordance with the laws of the State of Connecticut.

Know all men by these presents that:

- Grantor: _______________________________

- Address: _______________________________

- City, State, Zip Code: _______________________________

Hereby quitclaims to:

- Grantee: _______________________________

- Address: _______________________________

- City, State, Zip Code: _______________________________

The property described as follows:

Property Address: _______________________________

Legal Description: _________________________________________________

The Grantor hereby conveys all rights, title, and interest in the above-described property to the Grantee.

This conveyance does not warrant against any claims or demands of any person or entity.

In witness whereof, the Grantor has executed this deed on this _____ day of ________________, 20____.

Grantor Signature: _______________________________

State of Connecticut

County of _________________________________

On this _____ day of ________________, 20____, before me, ______________________________, a notary public, personally appeared ________________________ (Grantor's Name), who acknowledged that he/she executed the foregoing instrument for the purposes therein contained.

In witness whereof I hereunto set my hand and official seal.

Notary Public Signature: _______________________________

My Commission Expires: _______________________________

Dos and Don'ts

When filling out the Connecticut Quitclaim Deed form, it is important to follow certain guidelines to ensure accuracy and compliance. Here are five things you should and shouldn't do:

- Do ensure that all information is accurate and complete.

- Do include the correct legal description of the property.

- Do have the deed signed in the presence of a notary public.

- Do double-check that the names of the grantor and grantee are spelled correctly.

- Do file the completed deed with the appropriate town clerk's office.

- Don't leave any fields blank unless instructed to do so.

- Don't use informal language or abbreviations in the legal description.

- Don't forget to include the date of the transfer.

- Don't attempt to fill out the form without understanding the property details.

- Don't neglect to pay any required filing fees at the town clerk's office.