Free Quitclaim Deed Template for California

Other Popular Quitclaim Deed State Templates

Quit Claim Deed Form Kansas - It provides a simple way to gift property to someone else without a sale.

Quit Claim Deed Nh - It provides a formal way to relinquish any interest in a property without court involvement.

Recorder of Deeds Jefferson County Mo - The benefits of using a quitclaim deed often depend on the trustworthiness of the parties involved.

Misconceptions

There are several misconceptions surrounding the California Quitclaim Deed form. Understanding these misconceptions can help individuals navigate property transfer processes more effectively. Below is a list of common misunderstandings.

- A Quitclaim Deed Transfers Ownership Rights Completely. Many believe that a quitclaim deed transfers full ownership rights. In reality, it transfers whatever interest the grantor has in the property, which may be none at all.

- Quitclaim Deeds Are Only Used Between Family Members. While often used among family, quitclaim deeds can also be used in various transactions, including sales between unrelated parties.

- Quitclaim Deeds Eliminate All Liens on the Property. A common misconception is that a quitclaim deed clears all liens. However, existing liens remain attached to the property regardless of the deed type.

- Quitclaim Deeds Are Only for Transfers of Real Estate. Some think quitclaim deeds are limited to real estate. They can also be used for transferring interests in other types of property, such as personal property.

- A Quitclaim Deed Must Be Notarized to Be Valid. While notarization is often required for recording, a quitclaim deed can still be valid without it if all parties agree.

- Using a Quitclaim Deed Is Always Simple and Fast. Many assume that the process is straightforward. However, complications can arise, especially if there are disputes over ownership or existing liens.

- Quitclaim Deeds Are Irrevocable. Some believe that once a quitclaim deed is executed, it cannot be revoked. In fact, it can be revoked through mutual agreement or legal action.

By clarifying these misconceptions, individuals can make informed decisions regarding property transfers using quitclaim deeds in California.

PDF Form Details

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document used to transfer ownership of real property from one party to another without any warranties. |

| Governing Law | The California Quitclaim Deed is governed by California Civil Code Section 1091. |

| Use Cases | This form is commonly used among family members, in divorce settlements, or to clear up title issues. |

| Requirements | The deed must be signed by the grantor and notarized to be legally valid. |

| Property Description | A clear description of the property being transferred must be included in the deed. |

| Grantee Information | The name and address of the grantee (the person receiving the property) must be specified. |

| Recording | To ensure public notice, the quitclaim deed should be recorded with the county recorder's office. |

| Limitations | Quitclaim deeds do not guarantee that the grantor has good title to the property. |

| Tax Implications | Transfer of property via quitclaim deed may have tax implications, so consulting a tax advisor is advisable. |

Key takeaways

Understanding the purpose of a quitclaim deed is essential. This form allows a property owner to transfer their interest in a property to another person without making any guarantees about the title. It is often used among family members or in situations where the parties know each other well.

Ensure that all parties involved are correctly identified. The deed must clearly state the names of the grantor (the person giving up their interest) and the grantee (the person receiving the interest). Accurate identification helps prevent future disputes.

Filling out the form requires attention to detail. Be sure to include a legal description of the property. This description is more than just the address; it should detail the boundaries and specific location of the property.

After completing the deed, it must be signed and notarized. The presence of a notary public ensures that the signatures are valid and that the parties are acting voluntarily. This step is crucial for the deed to be legally binding.

Finally, record the quitclaim deed with the county recorder's office. This step is necessary to make the transfer official and to protect the rights of the grantee. Recording the deed provides public notice of the ownership change.

California Quitclaim Deed Example

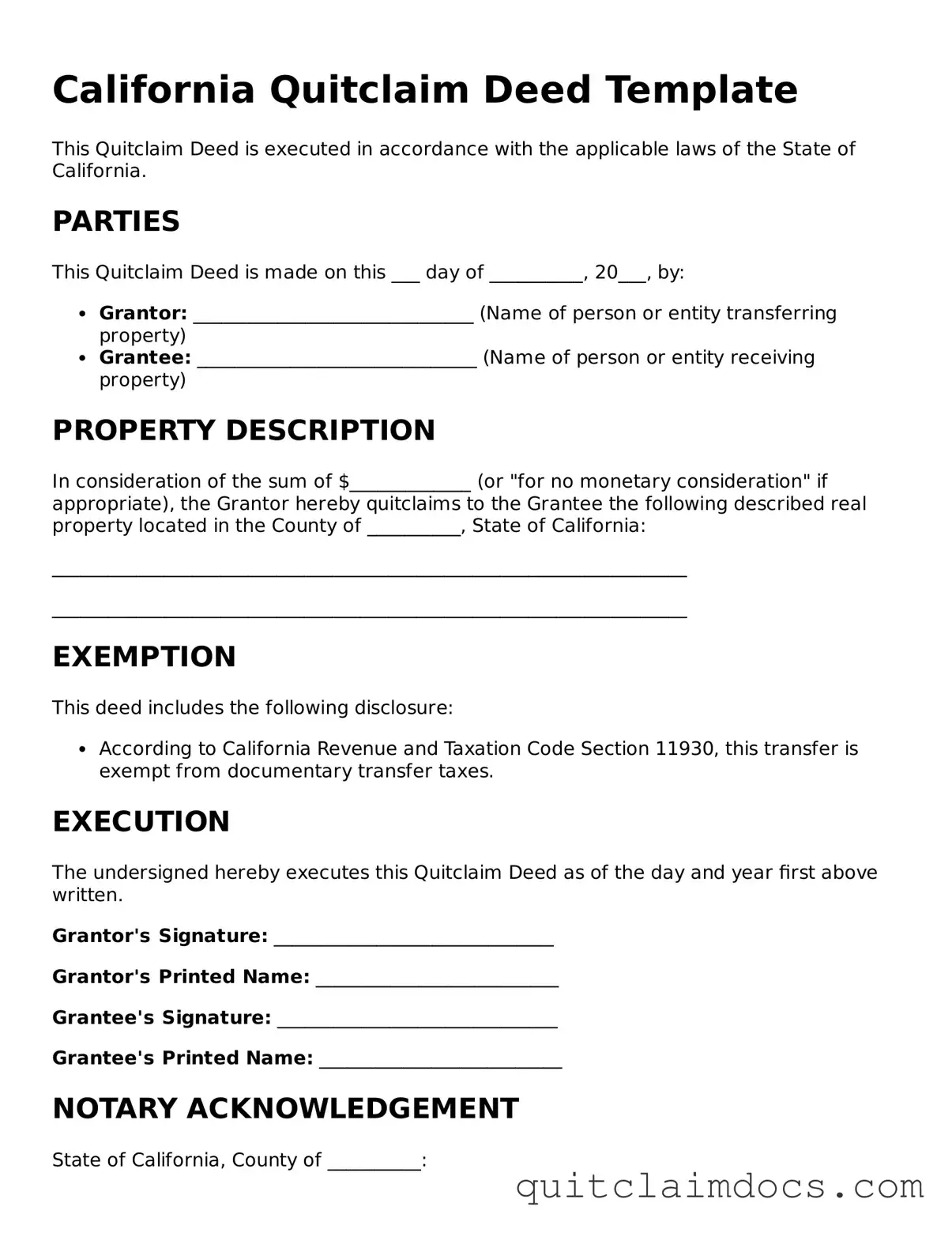

California Quitclaim Deed Template

This Quitclaim Deed is executed in accordance with the applicable laws of the State of California.

PARTIES

This Quitclaim Deed is made on this ___ day of __________, 20___, by:

- Grantor: ______________________________ (Name of person or entity transferring property)

- Grantee: ______________________________ (Name of person or entity receiving property)

PROPERTY DESCRIPTION

In consideration of the sum of $_____________ (or "for no monetary consideration" if appropriate), the Grantor hereby quitclaims to the Grantee the following described real property located in the County of __________, State of California:

____________________________________________________________________

____________________________________________________________________

EXEMPTION

This deed includes the following disclosure:

- According to California Revenue and Taxation Code Section 11930, this transfer is exempt from documentary transfer taxes.

EXECUTION

The undersigned hereby executes this Quitclaim Deed as of the day and year first above written.

Grantor's Signature: ______________________________

Grantor's Printed Name: __________________________

Grantee's Signature: ______________________________

Grantee's Printed Name: __________________________

NOTARY ACKNOWLEDGEMENT

State of California, County of __________:

On this ___ day of __________, 20___, before me, ________________________, a Notary Public in and for said State, personally appeared _______________________, known to me to be the person who executed the within instrument. The person acknowledged to me that they executed the same.

Notary Public Signature: __________________________

My Commission Expires: ____________________________

Dos and Don'ts

When filling out the California Quitclaim Deed form, it is important to follow specific guidelines to ensure the document is completed correctly. Here are some recommendations:

- Do: Ensure all parties involved are correctly identified, including full names and addresses.

- Do: Clearly describe the property being transferred, including the legal description.

- Do: Sign the form in the presence of a notary public to validate the deed.

- Do: Keep a copy of the completed deed for your records.

- Don't: Leave any fields blank; all sections must be filled out completely.

- Don't: Use ambiguous language when describing the property.

- Don't: Forget to check local recording requirements, as they may vary by county.

- Don't: Submit the deed without verifying that all information is accurate.